What is UPayCard

UPayCard is an e-wallet that lets you make online purchases, transfer money to other UPayCard account holders worldwide, and withdraw funds instantly & securely, all in 20 different currencies. It’s as easy as opening a free account, and you’re good to go. What’s great is that UPayCard also offers free physical cards, which you can use for in-store purchases or withdraw money from the cash machine globally. All physical cards are prepaid cards, which means you have to transfer money onto them before you can use them anywhere.

For those of you that have experience using cryptocurrencies, such as bitcoin, for online purchases, there is good news. With UPayCard, you automatically get a crypto wallet, which allows you to send, receive and buy Bitcoin, Ethereum, Litecoin and Ripple, and exchange them into any available currency.

Is UPayCard safe?

Safety & security is crucial when it comes to making money transfers. You want to be sure that your hard-earned money is safe and you won’t fall victim to fraud or hacking. UPayCard has various fraud prevention processes in place and is authorised and regulated by the Financial Conduct Authority (FCA) of the United Kingdom, under the Electronic Money Regulations for issuing of electronic money and provision of additional payment services. Legal jargon, we know, but basically it means that UPayCard has to go through the same screening processes like any other financial institutions in the United Kingdom.

Financial Conduct Authority (FCA)

The FCA is a financial regulatory body in the UK that regulates firms providing services to customers and maintains the integrity of the financial markets. The FCA is responsible for the conduct of almost 60,000 business with over 2 Million employees.

UPayCard Fees

We highly rate UPayCards transparency when it comes to fees. It’s all publicly available on their website, and you don’t even need to sign up for it. Have a look at the tables below where we’ve compiled all fees, whether its account to account, deposit to the account, withdrawals, and more.

Account

| Account creation | FREE |

| Monthly | FREE |

| Receive money | FREE |

| Send money | FREE |

| Balance check | FREE |

| Online Statement | FREE |

| Inactivity | FREE |

Deposit to Account

| Bank/Wire transfer | FREE |

| Mastercard transfer | 1.2 – 2.9% |

| Maestro transfer | 1.2 – 2.9% |

| Visa transfer | 1.2 – 2.9%$ |

| American Express transfer | 0.25 EUR + 3.9% |

| Paypal transfer | 0.35 EUR + 7% |

| iDeal transfer | 0.5 EUR + 1% |

| Skrill/Neteller transfer | 0.29 USD + 3.8% |

Withdrawal from Account

| Bank/Wire | 10 – 25 EUR |

UPayCard Reviews

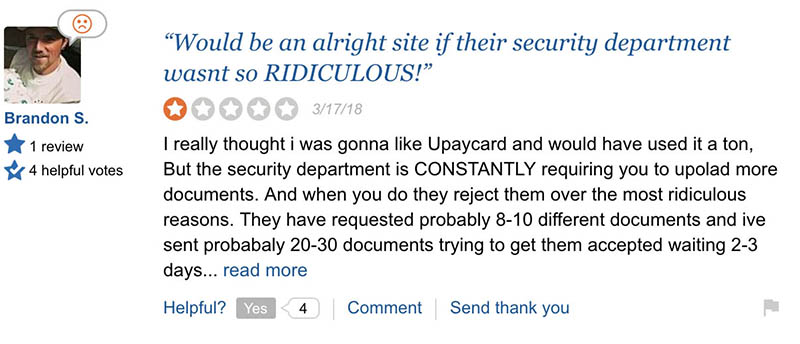

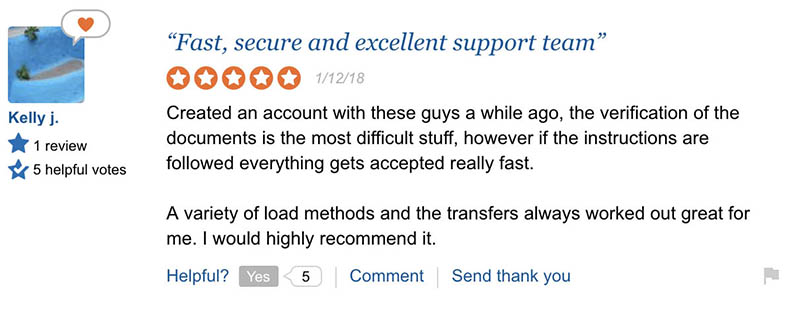

The reviews for UPayCard are somewhat mixed. Some people love the simplicity of the app and the customer service while others show frustration around the document verification, which seems to take a long time and is required before you can withdraw larger sums. The company is very new, and we often see negative and angry reviews when processes are not yet streamlined and correctly in place. We have reached out to the team at UPayCard for comment and will update this article with more information on this, but for now, we have added two reviews that show both, praise and anger.

Can I use UPayCard in Online Casinos?

Probably the question you are all waiting for is whether you can use UPayCard in UK online casinos. Unfortunately, much like popular Chinese payment method AliPay which has been rapidly expanding around the world, most established casinos have not adopted UPayCard yet, at least not those available to British players. Having experience in the online gambling world, we know it’s very complicated for casinos to integrate new payment methods as they have to go through a lot of legal steps, which takes time.

However, in the wake of the credit card ban, casino sites are urged more than ever to offer their players alternative payment methods. As a result, we might witness an increasing number of operators implementing UPayCard and other solutions as a result.

We are closely monitoring the situation and are in constant contact with UK gambling firms. The moment we have more information on the availability of UPayCard, we will let you know on this page. If you cannot wait and are looking for an alternative straight away, check out our guides to payment methods such as Skrill and Neteller, both e-wallets that also let you order a physical prepaid credit card.

Questions & Answers (FAQ)

What is UPayCard?

UPayCard is a new e-wallet that lets you make online purchases in 20 different currencies. Besides e-wallet access, you can order a physical card for in-store purchases.

Is UPayCard Subject of the Credit Card Ban in UK Casinos?

No, UPayCard is considered a prepaid credit card and therefore not banned by the UK Gambling Commission for making deposits at online casinos. However, operators are required to have mechanisms in place to avoid you using a credit card to fund your UPayCard e-wallet.

What's the Fee Structure at UPayCard Like?

It’s free to create a UPayCard account and send/receive money. However, the e-wallet does charge you for funding your account and withdrawing money. The fees depend on the chose payment method. Learn more